Retirement is a curse

Ratan Tata's email to my friend Jayant, my investment in MeritorQ and more.

I am an entrepreneur that has found success by focusing on daily progress. I share everything I learn on the road to wealth. Here are my insights from last week:

Retirement is a curse. Never retire!

The Minimum 4-Hour Rule

Why I have a SIP with MeritorQ

Warren Buffett’s Daily Routine

Always Try: Ratan Tata’s email to my friend Jayant

You can access previous editions of my weekly emails here. Let’s begin!

(1) Retirement is a curse. Never Retire!

There are 24 hours in a day.

We sleep for 8 hours.

We work for 8 hours.

And we do everything else in the remaining 8 hours.

If you were super-human and had never-need-to-sleep abilities, the maximum you can work for in a year is 24 hours x 365 days = 8760 hours.

If you work weekdays for 8 hours a day, the maximum you can work for in a year is 8 hours / day x 5 days / week x 52 weeks / year = 2080 hours (24% of a super-human).

If you work for 8 hours on the weekend as well, the maximum you can work for in a year is 8 hours / day x 7 days / week x 52 weeks / year = 2912 hours (33% of a super-human) (40% more than a normal workweek warrior).

The next most obvious question then becomes - "Why work more? Does putting in more hours = more money?"

It obviously does not. For example, someone who owns dividend stocks or rent yielding real estate can make 10 lacs a month in income irrespective of what he or she does with their time.

But the reality is that most people who work for an income have not reached a stage where their money is making them enough money to be financially independent. So they sell their time for money, as they should. Even here most people get paid a fixed salary so they can't just 3x their time to get 3x their pay. So they try to improve their skill sets to move up the ladder. They keep raising the ceiling by being able to do more with their time.

For those who feel like they are stuck in a rate race and are burdened with responsibilities, retirement is the dream. They want to be able to relax before they burn out. They dream of financial independence.

Let's assume for a minute that "you have made it!" That you are rich enough to not have to work again. Now what? What will you do with those 8760 hours a year?

You will sleep for 33% of the hours.

You will eat out, travel and spend time with loved ones for 33% of your time.

And the final 1/3rd of the time that you've escaped from is for _________ ? Watching TV? Reading? Gardening? Writing? Studying? Drinking Piña Coladas?

What will you do with your time? How will you fill that void?

Entrepreneurs go right back into starting up again. They get depressed just sitting around. They need to create.

People don't realize that discipline = freedom. The reason Warren Buffett is able to tap dance to work into his 90s is because he lives a disciplined life. His routine saves him from chaos. When I was studying in Canada I noticed how my friend's dad who had recently retired declined in health. He had worked every day of his life for decades and suddenly he didn't have to get up to work anymore. He had all this time that he didn't know how to spend.

I want to work. Till I die. Not because I will need the money but because I need the discipline. The nature of my work may change but my desire to work will stay the same. I like the game of life.

Never retire!

(2) The Minimum 4-Hour Rule

I am experimenting with what I am calling The Minimum-4-Hour Rule.

The Minimum 4-Hour Rule requires me to sit on my ass and work for long stretches of up to 4 hours in a given day. Once I reach 4 hours I stop tracking time. I usually put 1 hour timers on my watch to measure this, so when the timer goes off I may get up, stretch, look out at the distance for 20 seconds to reset my eyes, and then sit back down. Sometimes I'm just in the zone and keep extending the timer because I don't want to stop the flow I have created for myself.

This rule ensures I spend 25% of my waking hours focused. Even if the rest of my day is shit I get my minimum in. Even when I don't want to work in a given day, I still feel victorious because I make some progress. So far it's turning out to be quite a powerful strategy.

Earlier I had tried to do the reverse. I tried to measure every hour. It stressed me out. Instead of focusing on quality of work, my mind shifted to quantity of work. Instead of being happy with my effort, I was always in the "it's not enough" mode. Not a very sustainable way to survive a marathon!

Activity does not equal results. But there are no results without activity. In my work I have to keep switching between Maker-Time and Manager-Time. This Minimum 4-Hour Rule allows me to get my Maker-Time in early in the day so that by the time my team needs me to help them with sales, negotiations, closing deals, strategy, hiring or raising money, I am fully able to make the daily progress the business needs without compromising on the daily thinking the business needs.

(3) Why I have a SIP in MeritorQ

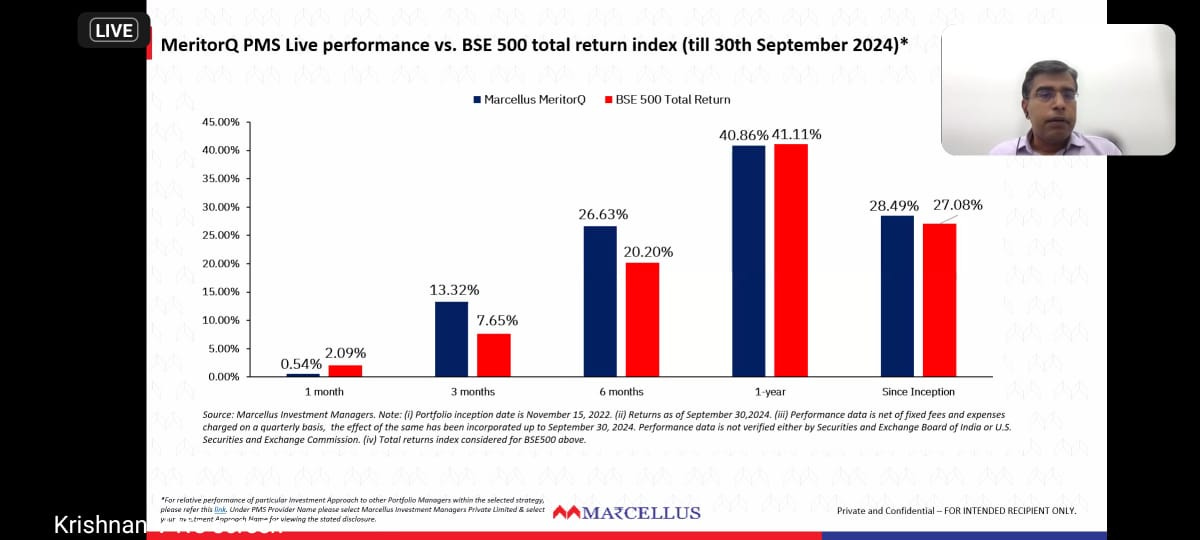

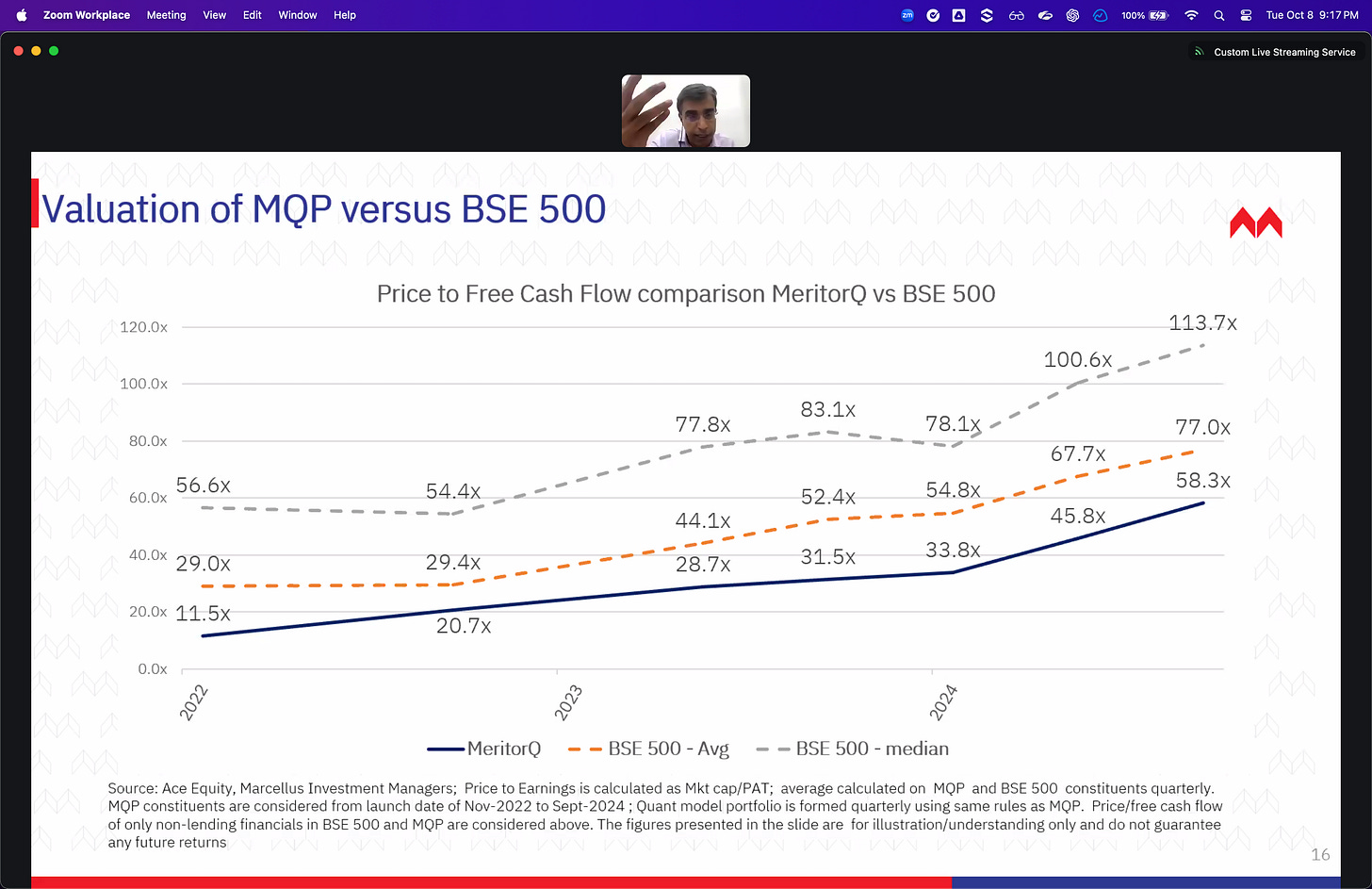

I have a SIP (Systematic Investment Plan) with MeritorQ so I sat in on this weeks Marcellus webinar to understand why they use Cyclically Adjusted Price to Earnings Ratio (CAPE) to make investment decisions.

Honestly, a lot of the intricacies of using ratios to understand what is going on goes beyond me. What I do understand is that these are companies which generate a lot of free cash flow, have little to no debt and do not partake in accounting shenanigans. The portfolio keeps adjusting the companies they own every three months to stay in line with valuations that are tied to their rule-based investment criteria. I actually liked seeing that there is margin of safety built in to the valuations so even when the market tanks, chances are that the portfolio will not tank as much.

The one thing which seems evident however is that the market is overvalued. Now that does not mean that the portfolios stocks are overvalued, but when a sell off starts, given the amount of retail investors who have come in the past four years, prices are likely to fall across the board. This made me question whether I should sell off everything and just hold on to cash. I have chosen not to do that because I am in it for the long-term, 10-20 years. While the prices may fall, eventually prices align with earnings per share, so dips will be averaged out by spikes over time.

I don't have the super-human abilities to time the market. When I tried to do it in the past I made mistakes, lost money and had sleepless nights. If I try again chances are that I will sell at the wrong time and buy at the wrong time again. I rather use my brain to build businesses and let the pros at Marcellus Investment Managers use their brains to make my money work for me.

(4) Warren Buffett’s routine to help him make 1 decision a year

On average Warren Buffett has made one big decision a year. Only 10 of these decisions have made him over 80% of his wealth. Now at age 94, he is worth approximately $140 billion.

I was curious to know what his daily routine looks like because even to make that one decision he needs to turn up everyday. Based on various interviews, documentaries, and biographies about him here is what we know:

MORNING

Wakes Up: Buffett wakes up early, though not extremely so, usually around 6:45 a.m.

Breakfast: He has a famously modest breakfast, often stopping by McDonald’s for something inexpensive. His breakfast choice depends on how he feels about the market that day. For example, he might have a $2.61 sausage, egg, and cheese biscuit if he’s feeling optimistic or a $2.95 bacon, egg, and cheese biscuit if he’s feeling particularly bullish.

Reads Newspapers: He spends the early morning hours reading. Buffett goes through five newspapers daily.

WORKDAY

Time at the Office: Buffett arrives at his Berkshire Hathaway office around 9 a.m. He has a small office with no computer and only a landline phone. His desk is famously clutter-free.

Reading: He spends 80% of his day reading. This includes company reports, financial documents, books, and anything that helps him learn more about businesses and markets. Buffett believes in making informed decisions, so he prioritizes gaining as much knowledge as possible.

Thinking: Buffett dedicates a significant portion of his time to thinking and reflecting. He avoids a packed schedule of meetings and phone calls, as he prefers to have uninterrupted time to think about investments and strategies.

Minimal Meetings: Unlike many CEOs, Buffett does not fill his day with numerous meetings. He only meets with key people and handles major decisions personally. His approach emphasizes making fewer but high-quality decisions.

LUNCH

Simple Lunch: Buffett is known for his simple diet, often opting for items like cheeseburgers, fries, and a Coca-Cola. He is an avid fan of junk food and jokes about his diet, claiming he eats like a six-year-old.

AFTERNOON

Reading & Thinking: The afternoons are much like his mornings, filled with reading, thinking, and occasional interactions with his team or business partners.

EVENINGS

Goes Home Early: Buffett usually leaves the office by around 5 p.m. to head home.

Time with Family: At home, he likes to spend time with his family. He might watch TV or play bridge, a card game he deeply enjoys. He’s known to play bridge online and occasionally with friends like Bill Gates.

Reading: He often continues reading at home in the evening as well, further emphasizing his dedication to lifelong learning.

SLEEP

Early to Bed: Buffett typically goes to bed around 10:30 p.m., ensuring he gets around 8 hours of sleep.

WEEKENDS

His weekends also revolve around reading, family time, playing bridge, and relaxing, sticking to his preference for simplicity and a life of continuous learning.

(5) Always Try: Ratan Tata’s email to my friend Jayant

My friend Jayant Mundra had reached out to Ratan Tata for financial help in 2016. To his surprise he got a response. Ratan Tata did not give Jayant money but he pointed him in the right direction and said:

"Make your mother so proud, that your father's happy tears will rain on you from the heaven's above."

Surprised that he even got a response, Jayant proceeded to take action again by following Rata Tata’s advice. The result? The Director of his college waived his hostel and mess fees to lower his financial burden.

Seeing how entrepreneurial Jayant is I feel like even if he had not heard back from Ratan Tata or the College, he would have kept on trying till he found a way. It is in the process of trying that a lot of new paths that you could never have imagined earlier open up to you.

Always try.

Harsh Batra (LinkedIn)

Whenever you are ready, here are 3 ways I can help you:

iDeals VDR - If you are running M&A transactions, planning an IPO, or sharing anything confidential online, you won’t find a better Virtual Data Room partner than us. Here is a 90 second video overview of iDeals. Companies like Pfizer, Mercedes and Tata trust us. Thousands of Indian investment bankers, lawyers and insolvency professionals use us everyday to run their due diligence processes. Send us an email on india@idealscorp.com so that we can customize your proposal and save you more time and money than anyone else in the industry.

Happy Ratio - I founded Happy Ratio because I am immensely passionate about health. To get the most out of life you need to be healthy. To be healthy you need to eat the right foods and drink the right beverages. But this is not always possible or easy. Happy Ratio provides clean, tasty and healthy foods and drinks. Our breads are baked fresh every morning with zero maida or preservatives. Our cold coffee meal shake gives you all 39 essential nutrients along with your daily dose of caffeine. We can replace one of your daily snacks or meals through our delicious yet healthy sandwiches, wraps, bowls, shakes and cold-press juices. Check out our menu on Zomato and Swiggy. We serve employees from Deloitte and Marks & Spencers and do events for companies like Samsung and Oppo. If you want to elevate the health of your employees or feed your family something healthy and tasty, reach out to us at ops@happyratio.com.

Marcellus Investment Managers - I am a Marcellus client because their investment philosophy resonates with how I think about investing. I believe that Marcellus can generate average returns of 18% per year over the next 10-20 years. That is 5x returns every 10 years. This means that 50 lacs invested can compound to 2.5 crores in 10 years. 2.5 crores can further compound to 12.5 crores in 20 years. And 12.5 crores can further compound to 62.5 crores in 30 years. Yes I know that those numbers seem outlandish but I think that their approach to investing in clean, honest and cash flow positive businesses can yield these returns if you have the patience to wait. I trust them with my savings and evangelize their approach. Investing comes with inherent risks so please do your own due diligence before deciding where to put your money. I am also an Independent Financial Advisor with Marcellus.