Health, Wealth & Purpose — 7 reasons you should "Die with Zero"

Every Sunday I share what I learn about health, money and business from books, podcasts and my experiences. I don't use AI to summarize my learnings because, for me, the real learning happens when I write and reflect on these notes myself. Here is what I learnt last week:

7 reasons you should “Die with Zero”.

Does the Mediterranean diet improve sperm quality?

Why 1 lac invested in this Indian company in 2008 is worth 10 crores today.

Does time restricted eating impact bone health?

You can access previous editions of my weekly emails here. Let’s begin!

(1) 7 reasons you should Die with Zero

Die With Zero. What a book title!

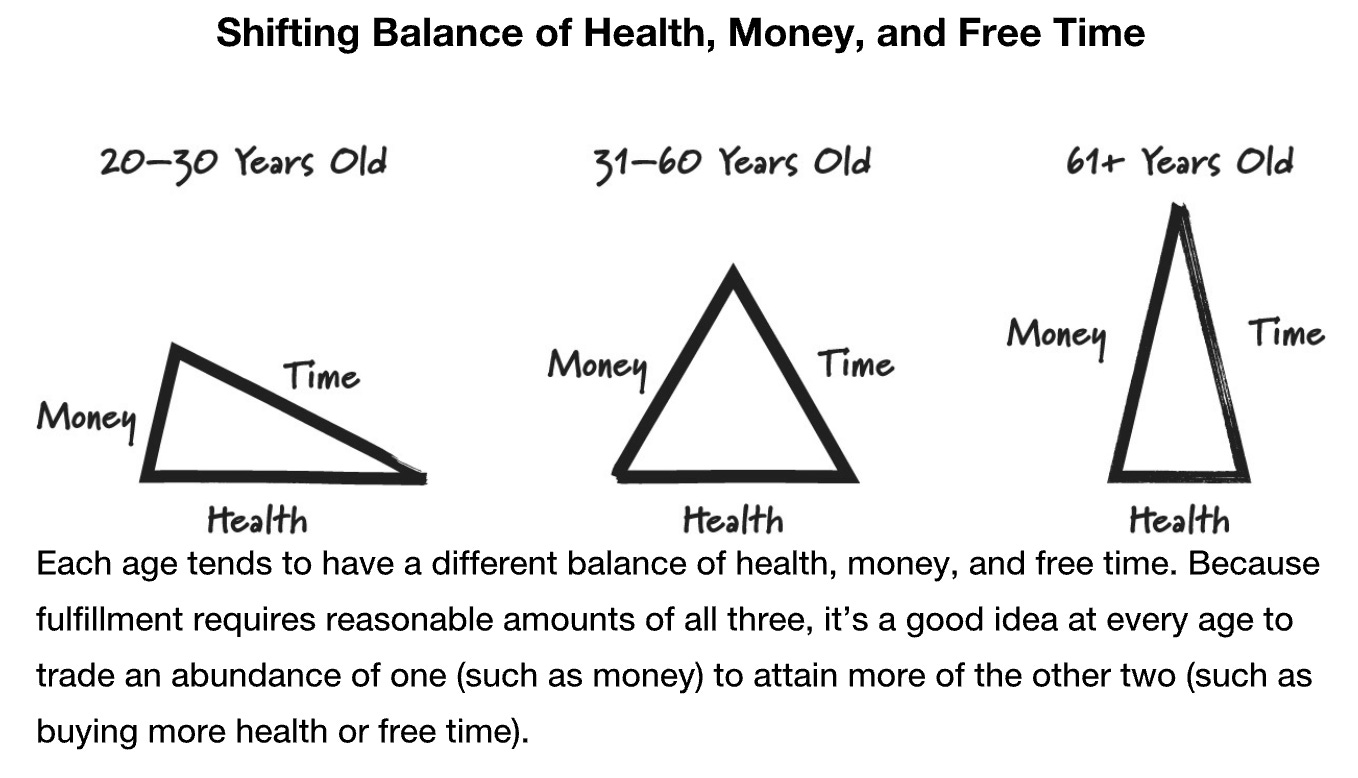

Bill Perkins has made me re-evaluate my assumptions on HEALTH, TIME and MONEY.

Here are 7 lessons I learnt from reading the book:

(1) THE POINT OF LIFE IS TO "MAXIMIZE POSITIVE LIFE EXPERIENCES".

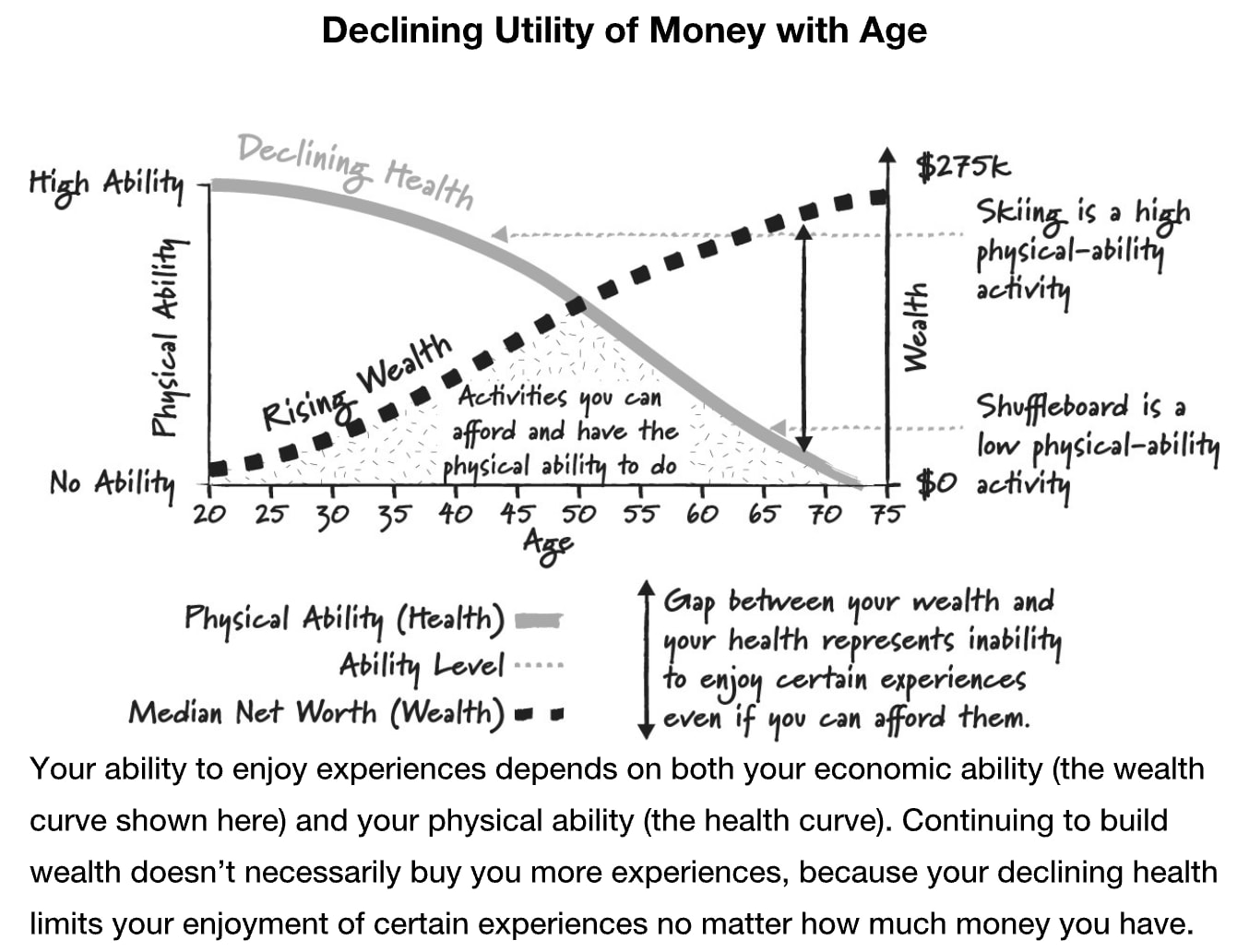

The business of life is the acquisition of memories. And as you get older, the utility of money changes.

(2) TO MAXIMIZE POSITIVE LIFE EXPERIENCES IT'S IMPORTANT TO HAVE THE RIGHT EXPERIENCES AT THE RIGHT AGE.

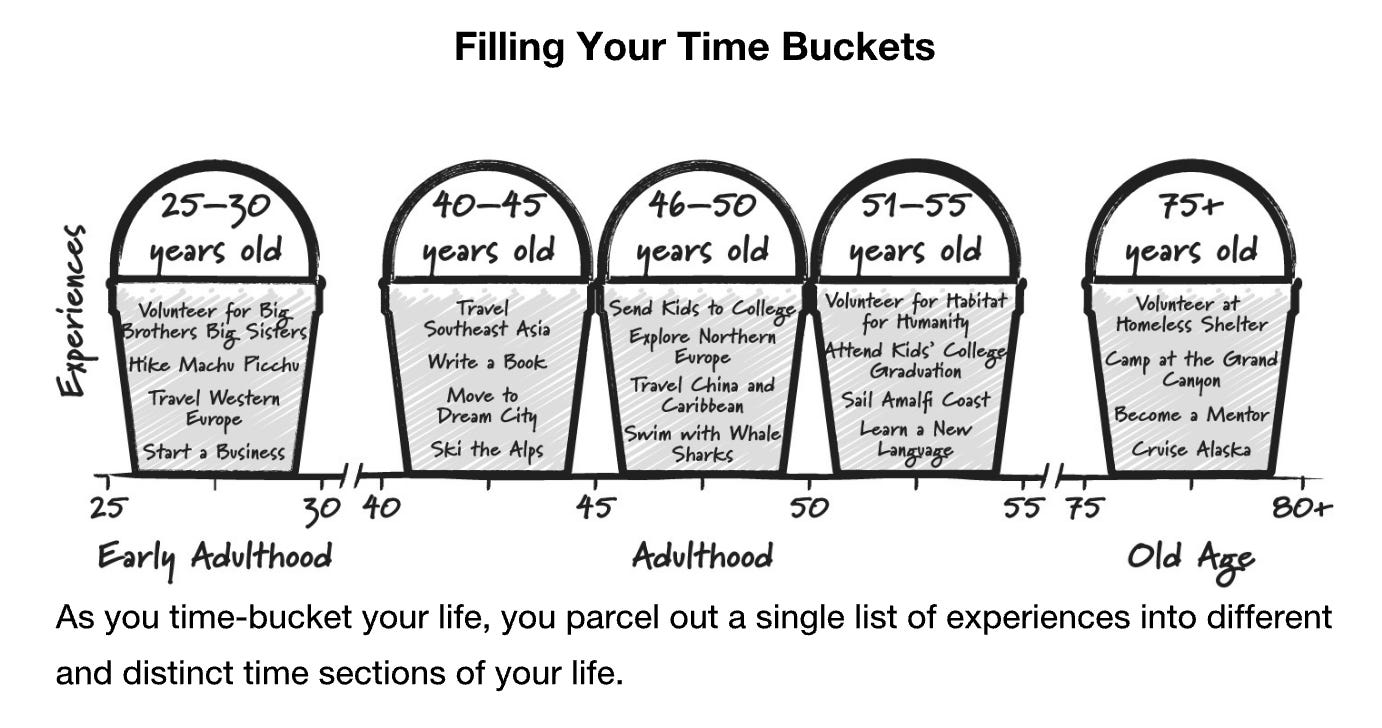

Think of your life as distinct seasons. Create a Time-Bucket based on your Age-Buckets.

We die many deaths in the course of our lives: The teenager in you dies, the college student in you dies, the single unattached you dies, the version of you that’s a parent of an infant dies.

Draw a timeline of your life from now to the grave, then divide it into intervals of five or ten years.

It’s extremely helpful to actually write them all down in a list. Your list will be your own unique expression of who you are, because your life experiences are what make you who you are.

Then, once you have your list of items, start to drop each of your hoped-for pursuits into the specific buckets, based on when you’d ideally have each experience.

You will find that the vast majority of the experiences you want to have will have to happen within about 20 years of midlife, in either direction—in other words, roughly between 20 and 60.

As you go through life, your interests change and new people enter your life, so it’s a good idea to repeat the time-bucketing exercise every now and then, such as every five or ten years.

(3) ALL THE MONEY YOU HAVE LEFT WHEN YOU DIE IS ALL THE EXPERIENCES YOU MISSED OUT ON.

The problem is that people continue to save well past that optimal point. People who save tend to save too much for too late in their lives. They are depriving themselves now just to care for a much, much older future self—a future self that may never live long enough to enjoy that money.

If you die with $1 million left, that’s $1 million of experiences you didn’t have. If you die with $50,000 left, well, that’s $50,000 of experiences you didn’t have.

(4) RESEARCH SHOWS THAT YOU WON'T BE ABLE TO SPEND THE MONEY YOU'VE SAVED BECAUSE OF THE HABIT OF SAVING.

A 2018 study from the Employee Benefit Research Institute shows that people are very slow to spend down (“decumulate”) their assets. Across ages, whether looking at retirees in their sixties or those in their nineties, the median ratio of household spending to household income hovers around 1:1. This means that people's spending continues to closely track their income - so as people's income declines, their spending does, too. This means that retirees aren't really drawing down all the money they've saved up.

So, clearly, people who back in their working years would have said they were saving up for retirement are not actually spending those retirement savings once they reach retirement.

(5) GIVE MONEY TO YOUR CHILDREN WHEN THEY NEED IT, NOT WHEN YOU DIE.

Innumerable families fight in court to get a piece of inheritance, usually a lifetime of their parents hard earned wealth. This tussle pits siblings against one another and breaks relationships.

Is there a way to avoid it?

The author makes a strong case that you should:

GIVE MONEY TO YOUR CHILDREN WHEN THEY NEED IT, NOT WHEN YOU DIE.

Putting your kids first means you give to them much earlier, and you make a deliberate plan to make sure that what you have for your children reaches them when it will make the most impact.

What would you guess is the most common age for people to get an inheritance? People at the Federal Reserve Board in the US track such things, and the average age is 60.

That is too late!

Because a person’s ability to extract real enjoyment out of the gift declines with their age. As your adult children age, every rupee you give them goes less far, and at some point that money becomes almost useless to them. You always get more value out of money before your health begins to inevitably decline.

The 26-to-35 age range combines the best of all these considerations—old enough to be trusted with money, yet young enough to fully enjoy its benefits.

(6) AVOID DEPRESSION IN RETIREMENT BY BEING VERY DELIBERATE ABOUT HOW YOU WILL SPEND YOUR TIME.

Many people enter retirement with only a vague idea of what they’ll do with all that free time. They tend to find themselves adrift, feeling aimless and maybe even itching to go back to work, the one place they know they’ll have a built-in sense of purpose, belonging, and accomplishment. In the worst cases, this sense of aimlessness can even lead to anxiety and depression.

So before you quit or scale back your job, really think through what you want to do once your work won’t be taking up much of your everyday time. Is there a long-dormant hobby you want to pick up again? A particular friendship you want to rekindle? A new skill you want to learn, or a club you want to join? What adventures do you really want to have—and when do you want to have them? Put those in the appropriate buckets and start making new memories.

(7) TAKE YOUR BIGGEST RISK WHEN YOU HAVE LITTLE TO LOSE

At the extreme, when the downside is very low (or nonexistent, as in the “nothing to lose” case) and the upside is really high, it’s actually riskier not to make the bold move.

The downside of not even taking a chance is emotional: potentially a lifetime of regret and wondering What if? The upside of taking a chance always includes emotional benefits—even if things don’t work out.

The Younger You Are, the Bolder You Should Be

When you’re older, some risks become more foolish than bold.

People are more afraid of running out of money than wasting their life, and that’s got to switch.

(2) Does the Mediterranean diet improve sperm quality?

In this research study, 2,032 men were studied. Out of the studies evaluated, all of them looked at sperm concentration and sperm motility. Whereas sperm morphology, sperm volume and total sperm count were used in some but not all the studies.

The result?

Eating a Mediterranean Diet or similar to a Mediterranean Diet was generally associated with better sperm quality parameters in both young and middle aged men.

What is the Mediterranean Diet? It is a diet in which olive oil, leafy green vegetables, fruits, whole grains, nuts, legumes, poultry, fish, low-fat dairy and red wine is consumed.

(3) Why 1 lac invested in this Indian company in 2008 is worth 10 crores today.

Out of the 200 trillion rupees Indian lending industry, it only has 2% of market share. Yet it has compounded around 30% per year for the past 15 years.

The idea of getting into this NBFC space came when Citibank ran a pilot with Bajaj Auto because they wanted to get into 2-wheeler lending. When the Bajaj Auto sales team tried to sell their Chetak Scooter with the help of this loan to Tata Motors executives in Pune, it did not work. But when they extended the same offer to Tata Motors employees, they sold 2000 of them!

As a result Bajaj Finance was born in 1987.

What is Bajaj Finance doing that makes it hard for others to copy?

(1) They service 98% of India's Pin Codes - As a result companies want to deal with them because they are present in 5000+ locations. This scale is very difficult and expensive to replicate.

(2) They approve loans in 90 seconds - Manufacturers of consumer products want their financiers to approve 80-90% of loans so that the consumer has a good experience and the inventory gets turned over faster. Their nearest competitors take 4 hours to approve a loan.

(3) Bajaj Finance upsells 6 times to the average customer - Bajaj finance looks at a disbursal of loan as a customer acquisition funnel. Not only does it make money on the first loan, but it is also able to upsell and cross sell 6 other products on average to the same customer and make money doing it. No other lender is able to replicate this. This is a function of the analytics they have on 200 million Indian customers.

(4) They have a database of 200 million Indians which they keep mapping out and refining with technology. Their database keeps getting better.

(5) Their architecture and work culture is an intangible advantage. Over 90% of their workforce is on variable pay based on targets. This ruthless performance minded culture has surprisingly got the least attrition. They tend to attract only like-minded people to the firm. They are very metric based, work 6 days a week, 10 hours a day and plan intensely.

Every year they have a week long range planning (LRP) session drawing up 5 year detailed plans with their 200 member leadership team. During this LRP process they study one successful global company like Amazon, Microsoft, Netflix, Booking.com, Starbucks to incorporate these companies learnings into their own strategy. Then they incorporate the hiring plan and annual budget for the next year. Typically what they've set out to do in 5 years they've done in 3 years. Similarly next years budget is achieved in 9 months. Over 25% of staff is in collections. Their on-ground execution and work culture is hard to replicate.

~~~

Let's also look at their best selling product called the NO-COST EMI. How do they make money if they don't charge an EMI?

Let's explain with an example: Let's say a 60,000 rupees fridge is sold.

The customer has to pay 5000/month over 12 months = 60,000. In addition to this he pays a nominal processing fee of 1000. Here is how everyone wins:

The customer gets to enjoy the product without paying any interest on it.

The manufacturer gets to sell his product.

The retailer gets to turn over his inventory faster.

And Bajaj makes money by getting a 5% discount on the MRP from the manufacturer. So they pay the manufacturer 57,000, sell to the customer for 60,000.

Bajaj's ROE has been 20% with 6x leverage. Others in the industry have an ROE of around 10% with more than 12x leverage.

What a business!

~~~

I learnt about what makes Bajaj Finance exceptional by listening to Saurabh talk with Tej on Coffee and Investing podcast.

(4) Does time restricted eating impact bone health?

313 adults were part of this research study to determine whether eating for 8 hours and fasting for 16 hours a day or eating for 12 hours and fasting for 12 hours made a difference to bone mineral density.

The result was that while the participants lost weight, there was no impact on bone mineral density.

Harsh Batra (LinkedIn)

Whenever you are ready, here are 3 ways I can help you:

Happy Ratio - The foundation of health is your diet. You should focus on eating nutrient dense meals. But this is not always possible or easy. Happy Ratio is the only quick service restaurant chain that is on a mission to make healthy food the default choice for Indians. We are present in Delhi NCR. Try us.

EthosData - If you are running M&A transactions, planning an IPO, or sharing anything confidential online, my team can run your Virtual Data Rooms. Companies like Tata, Reliance and Moody’s trust us.

Marcellus Investment Managers - I am a Marcellus client because their investment philosophy resonates with how I think about investing. I believe that Marcellus can generate average returns of 18% per year over the next 10 years through its funds. That is 5x your money in 10 years. Investing comes with inherent risks so please do your own due diligence before deciding where to put your money. I am also an Independent Financial Advisor with Marcellus.