Health, Money & Books (18 Feb 2024)

This week is about the food you eat, investing in small caps and learning from Jayant

This week’s reads focus on:

HEALTH - What I learnt from the documentary mini series on Netflix called You Are What You Eat.

MONEY - What I learnt about small cap investing from Marcellus.

BOOKS - What I learnt from Jayant Mundhra. Watch out for him. He is likely to make a name for himself.

Let’s begin!

HEALTH - You Are What You Eat

I watched the mini series called You Are What You Eat: A Twin Experiment on Netflix with my mom. They used twins that share the same DNA to measure the impact that different diets would have on them. They pitted a healthy omnivore (non-veg) diet with a vegan (only-plant) diet to measure results. Here are some insights:

What's more important than anything else is what you put in your mouth. Let food be my medicine and let medicine be thy food.

Taste is so important. Food is not just to nourish the body. It's to nourish the soul.

LDL Cholesterol went down significantly for vegans. High level of LDL Cholesterol clog up your arteries so are bad for your heart.

TMAO went up and stayed up for the omnivores. But went down and stayed down for the vegans. High levels are associated with heart disease, hardening of the arteries, diabetes, and colon cancer.

BIFIDOBACTERIA went up for vegans but stayed the same for the omnivores. Bifidobacteria are healthy bacteria found in your intestines that help digest fiber, prevent infections, and produce important compounds, such as B vitamins and healthy fatty acids.

TELOMERES increased for vegans vs the omnivores. Telomeres shorten with age. The fact they increased for vegans means that their biological age improved i.e. they became biologically younger.

The main message of the documentary was:

You can change your biology in a profound way just by changing your dietary pattern in a fairly short period of time.

A vegan diet is better than a omnivore diet.

The documentary goes into detail on how the meats we eat are produced and the environmental damage they are causing. It is terrible! It makes you want to stop eating all kinds of meat. If everyone that is a non-vegetarian gets to see how what they are eating got to their plate then most of us would lose our appetite.

Yesterday after playing a game of cricket, I went with some teammates to have a few beers and eat food. I tried to avoid the chicken but ended up still having it because the alternative was french fries. Changing habits requires making the change easy. The United States is taking the lead in this vegan movement. In India, we at Happy Ratio are also making it easy to switch to a healthy diet. We open in our third location at CyberHub in one week. If you are in Gurgaon, please try us!

MONEY - If god was an investor in small caps, he would make 122% per year

What is a small cap?

Usually market cap (the value of the company) determines how large a company is. In India:

Large caps are companies 1-100 by market cap.

Mid caps are 101 - 250.

Small caps are 251 - 6000. Small caps are usually valued at 20,000 crores ($2.5 billion) or lower.

Is the belief that small cap give higher returns than large caps true?

Yes.

If you had God's power of foresight then investing in the top 20 best performing small caps would have ended up giving you absolute returns per year of 122% over the past 10 years. That's more than doubling your money every year. If you had done the same for large caps, you would have got roughly half of this performance. Neither of us have Gods powers but at least we know what the best-case scenario looks like.

Even if you just follow the BSE small cap index, you would have ended up making 22% per year (annualized) for the last 10 years. If you compare this to NIFTY and BSE 500, which represent large and mid caps, you would have ended up making 16% per year.

You are basically aiming for 10x your money in 10 years with small caps vs 5x your money in 10 years with large and mid caps.

How can one make at least a fraction of what God can?

Identify the Small Caps that will be the future Large Caps. If you can identify those with moats that give them monopolistic characteristics and just back them till they compound their free cash flows to the top, then you as one of the owners (shareholders are owners!) of the business will become rich.

How do we identify them?

The BSE500 represents the top 500 companies in India by market cap. Every year, 50 get relegated to the minor leagues and 50 join the majors. That's 10% change. Your job is to figure out which 50 will enter the major league i.e. BSE 500. In the last 10 years, those that entered the BSE500 outperformed the BSE500 by 28%. That means that when the BSE 500 was giving 16% average returns, these new players were giving 45% average returns. That's crazy!

It is basically investing in a Tendulkar before he got into the Ranjis. You got to identify him before the world found out. Another great analogy is Jon Wright scouting Jasprit Bumrah for Mumbai Indians before the world knew who he was. Both these players became the best in the world.

Why do the new entrants to the BSE 500 make 45% vs the BSE 500s 16%?

Because when they enter the BSE 500, everyone finds out who they are! Demand goes up to buy their stocks. Analysts start writing about them. The news covers them. Institutions start buying them for their pension funds and mutual funds. They are profitable enough to enter the big league but now they are also popular. Demand drives the price up.

If investing in small caps provides such incredible returns then why doesn't everyone only invest in small caps?

When the markets are good, small caps may outperform large and mid caps by a margin. But it is also meaningfully lower than large and mid caps during a bear market. How low? Over a 10 year period ending 2020, BSE small cap index only produced 9% per year compared to BSE 500s 16% per year. In between this period the prices went down as low as 47%. So you really need to ask yourself if you're ok with losing almost half your notional wealth without losing your mind.

Small caps are 2x as risky as large caps if you see the down months in prices over a 10 year period (22 months vs 10 months). Returns are not 2x per year in comparison (22% vs 16%). You really need a special kind of temperament to ignore the market and believe in the fundamentals.

Why is there this huge variance between small and large caps?

(1) When you're betting in a small cap you're betting on the promoter. Imagine a powerful cricket captain who is also the coach and selector; the chance of match fixing is high. So you better be sure who you are giving your money to.

(2) The accounting and governance risk is higher. More chances of fraud because they are not under the microscope of many analysts and institutions.

You're a Zebra in a Jungle

If you're part of the herd and graze around the middle, you are safe, but you will get less to eat. If you want more, you will have to go to the edges where you might get attacked by a lion. What kind of zebra you are should determine what kind of investments you make.

What's the advice if you want to invest in a small cap?

Do it via professional management. You trying to go and meet the promoter to figure him and the business out if not advisable.

Have limited exposure.

Don't take this as a hobby. This is a full time job not a side hustle!

Invest long term. Things even out, especially for small cap.

Have an investment philosophy. For example have frameworks like - are they generating profits, cash and ROCE? What is the debt to equity ratio on the balance sheet? Judge the quality of the management based on past decisions.

Conclusion

In the last 3 years, small caps are up 150%. 3x more Indians are investing to get a piece of this pie. Greed is rampant. But nothing lasts forever. And when the floor caves from under you, the emotional turmoil it brings is not worth it. What shines isn't always gold.

In 2017 small caps doubled but in 2018 and 2019 they lost as much as 80%. Don't get sucked into folly. Always stick to the fundamentals. And only invest with those who have their and their families money in the same investments are yours.

*These stories and ideas are from the Coffee and Investing Podcast: Small cap investing.

BOOKS - Redemption of a Son: An Unheard And Untold Tale of Breaking And Making of a Son

My LinkedIn feed showed me a post by Jayant Mundhra. It had a link to join his WhatsApp group called Biz News+. I joined out of curiosity. I was amazed at how effectively Jayant had been able to bring together his community. I want to do something similar for Happy Ratio because we are getting incredible customers who are coming eating and drinking with us. I want to be able to bring them together under one roof.

On his WhatsApp group Jayant has the option to Book his time so I paid to get on a Zoom call with him. I was amazed at Jayant's clarity of thought. I have met very few people who can think so methodically.

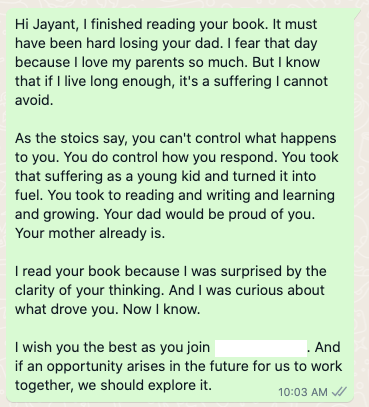

I was curious to learn more about Jayant after the call. I saw that he had self published a book called Redemption of a Son: An Unheard And Untold Tale of Breaking And Making of a Son. After I finished reading his book I sent him the below message:

Jayant lost his father, the only earner in the family, to an accident when he was just about to start university. The book is about how much his father meant to him, his guilt for not appreciating his efforts and how he found his purpose in life through reading and writing. I was surprised that he put himself and his vulnerabilities out on a public platform. This book was written about 5 years ago. Just based on the very little I know of him I can tell that his writing, experience and maturity has grown multifold since then.

Jayant is financially on his way to freedom because of his intellectual capacity to invest based on a thesis he creates. He invests in equities based on triggers. He maps out these triggers in a manner that he can predict the next 6 months to 2.5 years. He bases his investments based on the learnings he has absorbed from:

Howard Marks - make money without downside.

Jhunjhunwala - focus on just a few companies. When you sit with management they should wonder how he knows so much about us.

Warren Buffett

The skill he has developed to turn data into insight is quite remarkable. This is why he has been able to create a community that values his insights.

Harsh Batra

LinkedIn

I build businesses (EthosData, Happy Ratio), evangelize equity investments that 10x your savings (Marcellus), and write about money and personal growth (subscribe and grow with me).