Complimenting Strangers Produces a Ton of Joy

Giving is more fun than receiving

I am an entrepreneur. I believe in the mantra of “daily progress”. I share everything I learn on the road to wealth. Here are insights from last week:

Complimenting strangers produces a ton of joy

Which of these are you?

Warren Buffett’s finish line

You can access previous editions of my weekly emails here. Let’s begin!

(1) Complimenting strangers produces a ton of joy

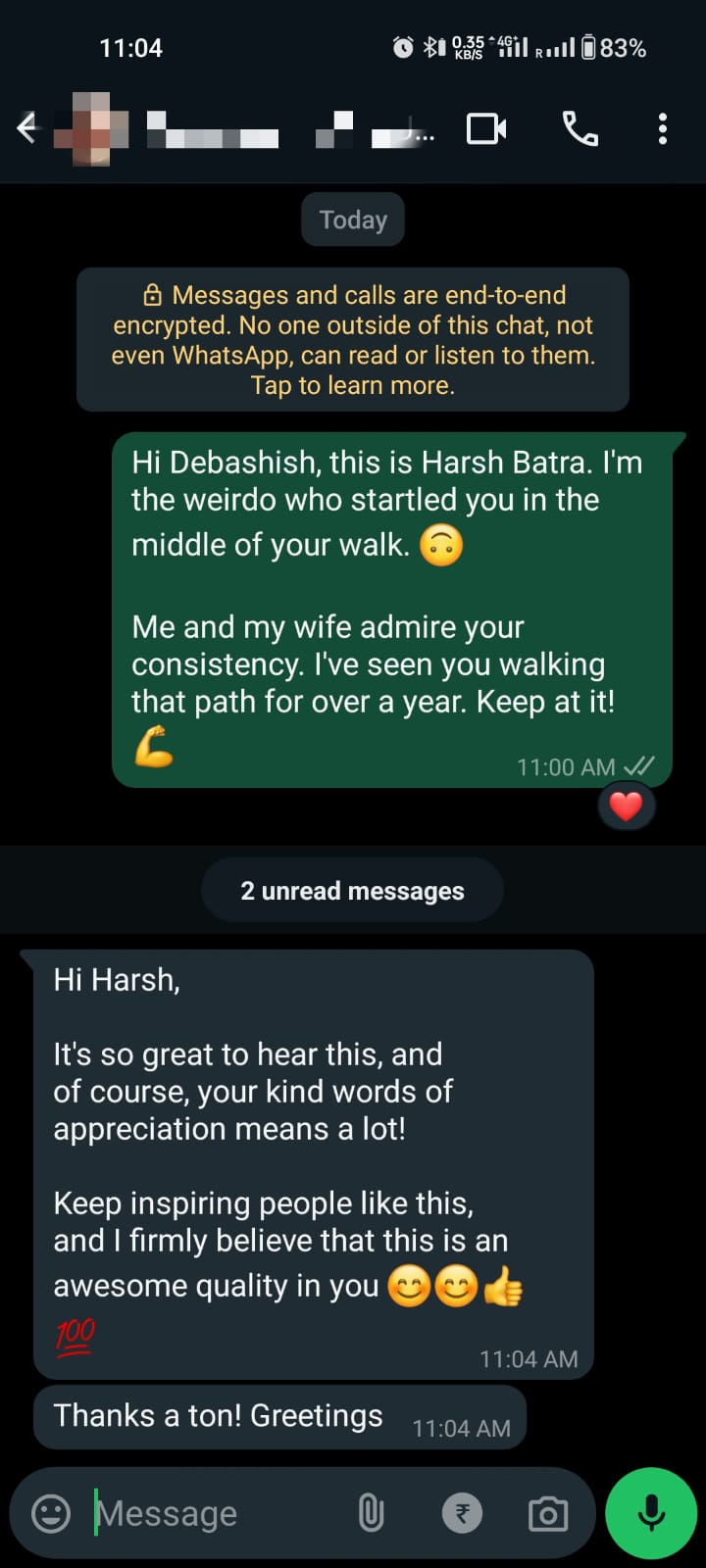

I was wired on caffeine, headed to the gym. I saw this man across the street. I swerved my car towards him, startling him in the process.

I pulled my window down and said "I have been watching you walk this path for over a year. You have lost a lot of weight. Every time me and my wife see you walking we admire your consistency. Well done!"

Debashish was taken aback but I seem to have made him happy. I seem to have made myself happy in the process as well.

We exchanged numbers. I added him to my WhatsApp group. I don't know if our paths will ever cross again. But a tiny thread has been created. Now we shall let serendipity do its thing.

I have consistently found that giving produces more joy than receiving as long as it is sincere. Everyone is fighting a battle you know nothing about. So when you disrupt someones day with a tiny act of thoughtfulness, you create positive vibes. In the process you feel good about yourself too.

(2) Which of these are you?

- Student / Teacher

- Son / Daughter

- Mom / Dad

- Employee / Entrepreneur

- Investor / Businessman

- Politician / Voter

- Influencer / YouTuber

- Citizen

- ……

Why aren’t you everything?

Life is long enough to be everything and do everything.

When I am in my deathbed, I don’t want to say “I wish I had done that!”

I want to say “I did it all. What a life!”

(3) Warren Buffett’s Finish Line

In a recent Marcellus podcast, Saurabh and Tej talked about the key takeaways from Warren Buffett's life. The one which stood out to me the most was how Buffett built his business to last forever. He built it to not have a finish line.

"We want the company to be financially impregnable and never dependent on the kindness of strangers or friends. We like to sleep soundly and we want our creditors, claimants, and shareholders to do the same as well." - Warren Buffett

This is a far cry from the risk that some of us take to make a few extra bucks. Anything multiplied by 0 = 0. One wrong move and it may be our last. Why not follow the Warren Buffett way and look to invest in ways that let's us sleep well at night?

Don't get me wrong, Berkshire Hathaways has made a ton of money while neglecting risky bets. If you look at Berkshire’s track record, they has compounded at an astonishing 20% per year for 60 years. The S&P 500 has compounded during the same period at 10% per year. This means that Berkshire's stock has increased in price 38,000 times vs S&P 500s 250 times. If Berkshire Hathaways were to lose 99% of their stocks value today, they would still be way ahead of the S&P 500!

Here are other lessons I learnt from the podcast:

- Try not to make emotional decisions. Wisdom is learning from the mistake of others. Let’s learn from Buffett’s mistake. The story goes that Buffett had accumulated a substantial amount of stock in Berkshire Hathaways. The CEO of Berkshire at that time offered to buy back those stocks at a price of $11.50 per share. When the written offer came however, the offered price was $11.38 per share, not the price that had been verbally agreed. This infuriated Warren who went on to buy the whole company to fire the CEO. This was an emotional decisions. This mistake cost Buffett $200 billion in lost opportunities. Berkshire Hathaways, the textile business, declined till it was shut down over the next decade. The name however remained as Buffett went on to make a holding company through which he bought others businesses.

- The more you change and adapt, the more you will win. Warren Buffett made 28% per year over 12 years by buying ok companies at great prices. Despite this insane success, he changed to buying great companies at fair prices. This change in thinking, thanks to Charlie Munger, made him buy See's Candy, GEICO, Coke and American Express, which over time made him and his shareholders billions. He changed again from staying away from tech stocks to becoming the largest shareholder of Apple, making $200 billion in the process. When the Global Financial Crises was crippling businesses, Buffett changed by creating structured debt and equity deals that he had never done before to make money that no one else could make because he had the liquidity and ability to fund businesses that were in desperate need of capital. Changeability and adaptability are critical for success. Do not cling on to what worked for you in the past if the need of the hour is for you to adapt to what is needed today. Any profitable enterprise will be attacked by competition. You must evolve with the times.

Final thoughts on India: Everyone in India seems to have made money over the past three years. The number of equity investors in India has skyrocketed from 3 crores (30 million) in 2020 to 10 crores (100 million) in 2024. In this period their money has probably doubled. The real question however is if you can make consistent money over the next 10, 20 and 30 years. Can you think with a "forever timeline" like Buffett? Can you do it while sleeping peacefully at night?

Harsh Batra (LinkedIn)

Whenever you are ready, here are 3 ways I can help you:

Happy Ratio - Being sick sucks! To get the most out of life you need to be healthy. To be healthy you need to eat the right foods and drink the right beverages. But this is not always possible or easy. Happy Ratio provides clean, tasty and healthy foods and drinks. Our breads are baked fresh every morning with zero maida or preservatives. Our cold coffee meal shake gives you all 39 essential nutrients along with your daily dose of caffeine. We are not trying to replace the ghar ka Daal Chaawal or the weekend Dominos, McDonalds and Haldirams indulgences. What we are doing is replacing one of your daily foods and drinks through our delicious yet healthy sandwiches, wraps, bowls, shakes and cold-press juices. Check out our menu on Zomato and Swiggy. Employees from Deloitte and Bain break the monotony of their day to day routine by eating and drinking our tasty combos, feeling better in the process. And now we are doing corporate events for companies like Samsung and Oppo. If you have a company in Delhi NCR, reach out to us at ops@happyratio.com. We would love to do your next event.

iDeals VDR - If you are running M&A transactions, planning an IPO, or sharing anything confidential online, you won’t find a better Virtual Data Room partner than us. Here is a 90 second video overview of iDeals. Companies like Pfizer, Mercedes and Tata trust us. Thousands of Indian investment bankers, lawyers and insolvency professionals use us everyday to run their due diligence processes. Send us an email on india@idealscorp.com so that we can customize your proposal and save you more time and money than anyone else in the industry.

Marcellus Investment Managers - I am a Marcellus client because their investment philosophy resonates with how I think about investing. I believe that Marcellus can generate average returns of 18% per year over the next 10-20 years. That is 5x returns every 10 years. This means that 50 lacs invested can compound to 2.5 crores in 10 years. 2.5 crores can further compound to 12.5 crores in 20 years. And 12.5 crores can further compound to 62.5 crores in 30 years. Yes I know that those numbers seem outlandish but I think that their approach to investing in clean, honest and cash flow positive businesses can yield these returns if you have the patience to wait. I trust them with my savings and evangelize their approach. Investing comes with inherent risks so please do your own due diligence before deciding where to put your money. I am also an Independent Financial Advisor with Marcellus.